Navigating Shifts in the Diamond Industry: Market Dynamics and Long-Term Outlook

Navigating Shifts in the Diamond Industry: Market Dynamics and Long-Term Outlook

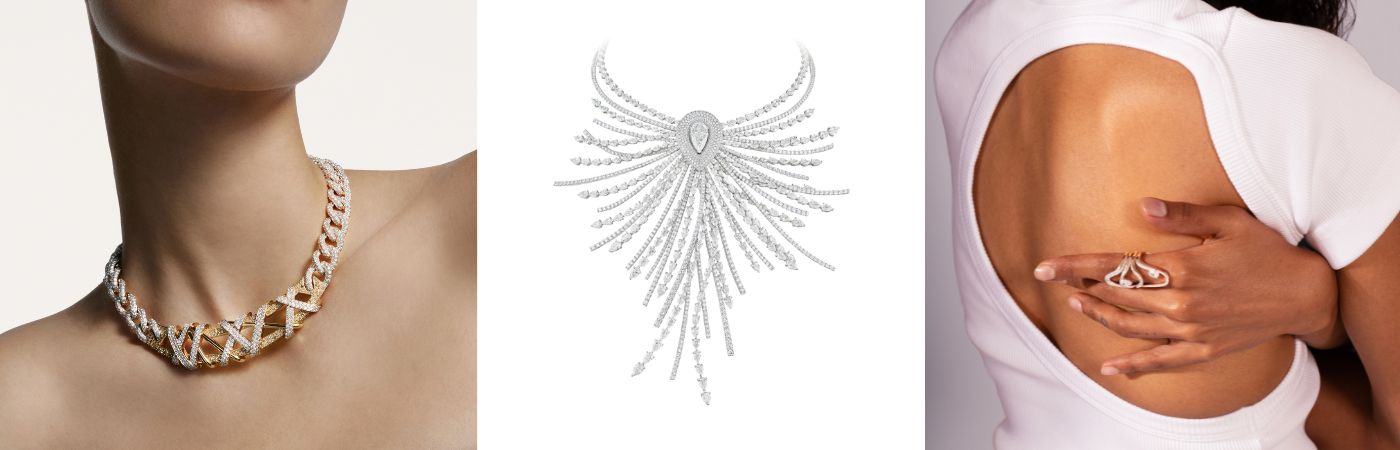

Credits: Piaget @piaget

Demand was impacted by the bridal catch-up effect after COVID-19 restrictions eased, macroeconomic headwinds, and increasing demand for lab-grown diamonds, particularly in the US. In addition, short-term supply was affected by changes in midstream and downstream stock levels. This resulted in a weakening of the value of rough natural diamonds. The drivers of the natural diamond industry differ in the short and long term. The short-term outlook is driven by, among other factors, stock levels in the midstream value chain segments and retail propensity to restock before and after key selling periods. The long-term outlook is driven by supply and demand fundamentals. While demand conditions may remain uncertain in the short term, a more positive long term industry outlook is supported by constrained primary supply, rising global affordability underpinning demand growth, and industry initiatives (for example, effective marketing and retailer collaborations) to reinforce the desirability of natural diamonds.

Credits: Pomellato @pomellato, Gismondi 1754 @gismondi1754, Marie Mas @marie_mas_jewelry

Suppressed exploration budgets over the past decade, a scarcity of large new discoveries, and lengthy mine development timelines make it difficult to foresee significant new volume increases, although there is some potential for brownfield expansion of cyclically viable supply if prices rise. Long-term demand for natural diamonds is driven by three main dynamics shaping natural diamond demand: the continuing rise of brands, which is driving growth in diamond jewellery and capturing a larger share of value in diamond jewellery sales; lab-grown diamonds demand, including the timing and degree to which lab-grown adoption will peak within these ten years; and the relative desirability of diamonds versus gold, other gemstones, and alternative discretionary spending (including experiences) among the growing middle class in Asia. Given the instability of the past five years, understanding the industry outlook requires a fundamentals approach: the likely outlook on many factors is not necessarily a continuation of momentum. This also means the natural diamond industry cannot stay idle. A positive demand outlook is also driven by several industry initiatives. These include effective marketing to support category and industry collaborations that reinforce the desirability of natural diamonds among US consumers, and continued efforts to build desirability in Asia. The short-term outlook is influenced by midstream stock levels and midstream risk perception, as well as the propensity of retailers to restock before and after key sales periods. In contrast, the long-term outlook is driven by the long-run equilibrium of supply and demand, which is based on consumer demand and expected return on supply investments.

Credits: Chantecler @chantecler_official, Boucheron @boucheron

The extent and timing of lab-grown diamond differentiation will depend on the trajectory of future price changes and the positioning of lab-grown and natural diamonds, as this will affect retailer margins and therefore the incentive to promote lab-grown and shape their consumer perceptions of desirability compared with that of natural diamonds. The US is anticipated to remain the biggest contributor to the diamond industry’s future value growth. India is emerging as the second largest diamond-consuming country, overtaking China in terms of total value based on polished wholesale prices. China’s demand is expected to be challenged in the near term owing to consumer caution, with a tendency to invest in gold due to its perceived stable investment value. New natural diamond supply remains limited. The industry has an opportunity—unique among mined products—to catalyze industry participants across the value chain to continue to restore the attractiveness of natural diamonds and stimulate demand in new demographics, growing emerging markets, and new purchase occasions.